Popular Candlestick Signals

Explore the various candlestick signals used in trading:

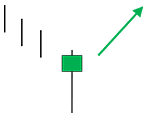

Hammer

The Hammer is a bullish reversal pattern that forms after a decline. It signals that the market is beginning to reverse and buyers are gaining control.

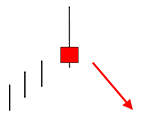

Shooting Star

The Shooting Star is a bearish reversal pattern that appears after an uptrend. It indicates a potential reversal as sellers start to take control.

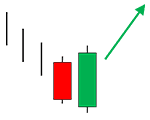

Bullish Engulfing

The Bullish Engulfing pattern occurs when a small red candlestick is followed by a larger green one, engulfing the first. It indicates strong buying pressure.

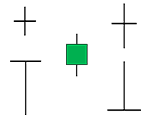

Doji

The Doji is a neutral pattern that indicates indecision in the market. It appears when the opening and closing prices are almost the same, suggesting that the trend could change direction.

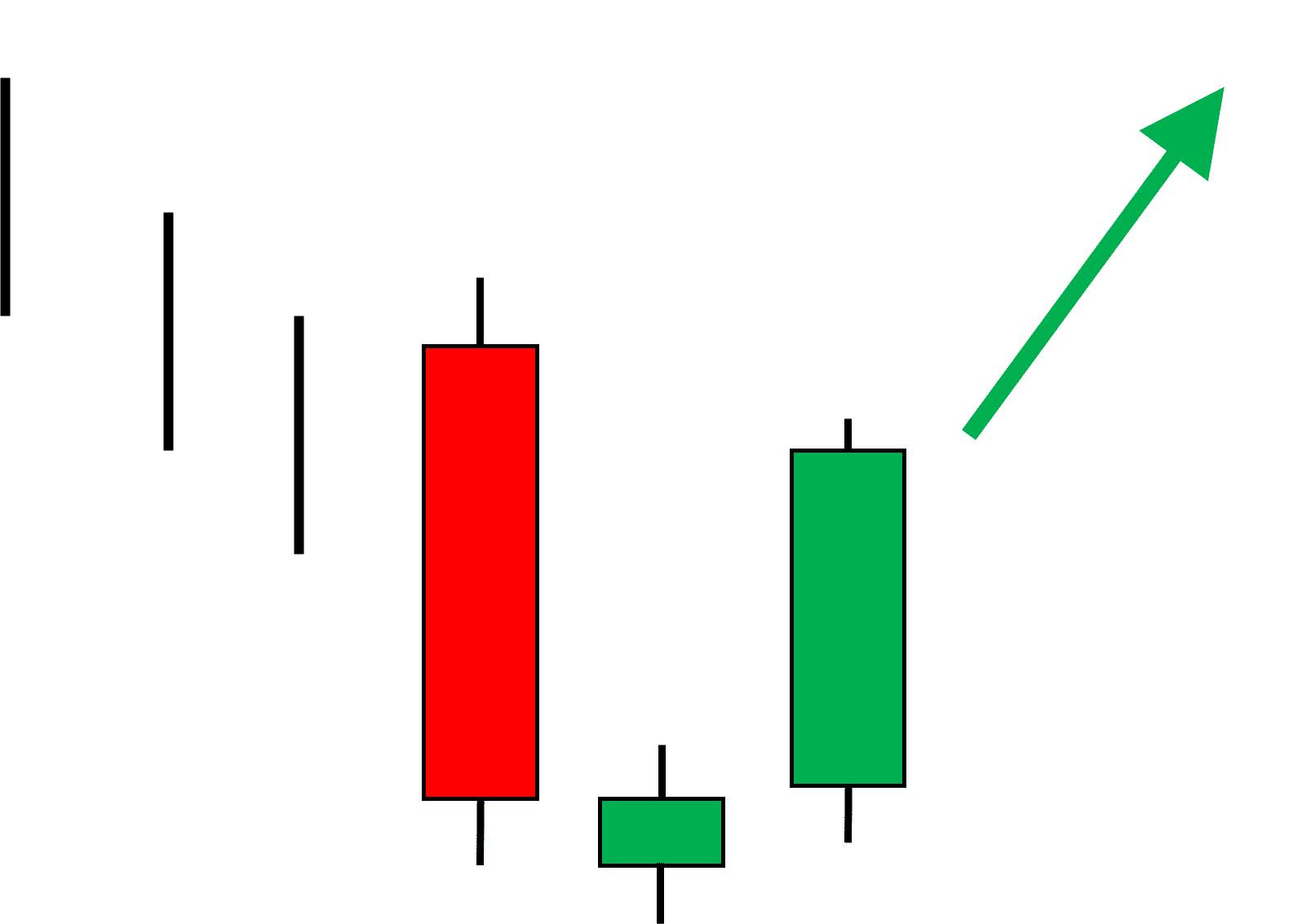

Morning Star

The Morning Star is a bullish reversal pattern made of three candles. It shows a downward trend starting to reverse into an uptrend.

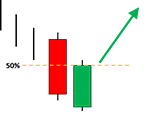

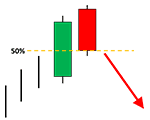

Piercing Line

The Piercing Line is a bullish reversal pattern where a gap down is followed by a close above the midpoint of the previous red candle. It signals a potential upward reversal.

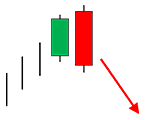

Bearish Engulfing

The Bearish Engulfing pattern occurs when a small green candlestick is followed by a larger red one, engulfing the first. It suggests a strong bearish reversal.

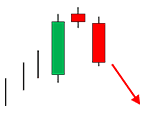

Evening Star

The Evening Star is a bearish reversal pattern consisting of three candles. It signals that the upward trend is coming to an end and a downtrend may follow.

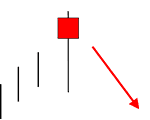

Dark Cloud Cover

The Dark Cloud Cover is a bearish reversal pattern where a large green candle is followed by a red candle that closes below the midpoint of the green candle. It indicates potential bearish reversal.

Hanging Man

The Hanging Man is a bearish reversal pattern that forms after an uptrend. It suggests that the market might be ready for a downturn as selling pressure increases.